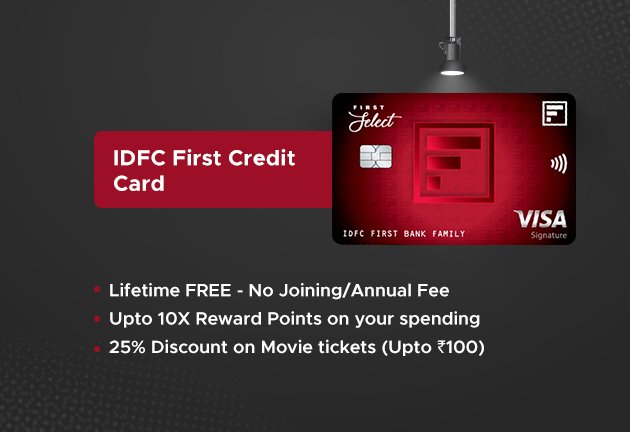

IDFC FIRST Bank Select Credit Card

Looking for a premium credit card without annual fees? The IDFC FIRST Bank Select Credit Card might be exactly what you need. In this comprehensive review, we’ll explore whether this lifetime-free card delivers genuine premium value or if it’s too good to be true.

IDFC Select Credit Card: Key Features Overview

The IDFC FIRST Bank Select Credit Card breaks traditional rules by offering premium benefits without charging joining fees, annual fees, or renewal charges. But what makes this card truly special in India’s competitive credit card market?

Why Choose IDFC Select Credit Card?

Lifetime Free Premium Benefits

- Zero joining fee and annual fee

- Premium travel and lifestyle perks

- Competitive reward rates

- Low forex markup charges

IDFC Select Credit Card Benefits: Complete Breakdown

Welcome Offers and Bonuses

₹500 Gift Voucher Welcome Benefit Spend ₹5,000 within 30 days of card activation and choose from popular brand vouchers:

- Amazon vouchers

- BigBasket vouchers

- Uber vouchers

- Lifestyle vouchers

EMI Cashback Offer Get 5% cashback up to ₹1,000 on your first EMI transaction within 30 days – perfect for big-ticket purchases.

IDFC Select Credit Card Airport Lounge Access

Domestic Airport Lounges

- 2 complimentary visits per quarter

- Access to 30+ airport lounges across India

- Advance booking available through DreamFolks

- Activation requirement: Spend ₹20,000 in current month for next month’s access

Railway Lounge Benefits

- 4 complimentary visits annually to select railway terminal lounges

- Same ₹20,000 monthly spend requirement (effective February 2025)

Travel Insurance and Protection

Comprehensive Travel Coverage (₹25,000 equivalent)

- Lost checked baggage: ₹8,300

- Delayed baggage: ₹5,600

- Lost passport coverage: ₹5,600

- Flight delay compensation: ₹5,600

Cancel For Any Reason (CFAR) Coverage

- Reimbursement up to ₹10,000 for non-refundable bookings

- Covers both flights and hotels

- Maximum 2 claims per policy period

- Unique benefit rarely found in other cards

Personal Accident Insurance

- Air accident cover: ₹1 crore

- Personal accident cover: ₹5 lakh

- Lost card liability: ₹50,000

IDFC Select Credit Card Reward Points Structure

How IDFC Select Credit Card Rewards Work

Accelerated Earning Rates

- 10X reward points: Incremental spends above ₹20,000 per statement cycle

- 10X reward points: All purchases on your birthday

- 3X reward points: Spends up to ₹20,000 per statement cycle

- 3X reward points: Education, wallet loads, government, rent transactions

- 1X reward points: Utilities and insurance payments

Reward Point Value

- 1 reward point = ₹0.25

- Earn 1 point per ₹150 spent

- No expiry: Points remain valid as long as card is active

IDFC Select Credit Card Reward Calculation Example

Monthly Spending Scenario (₹30,000)

- First ₹20,000: 3X points = 400 points = ₹100

- Next ₹10,000: 10X points = 667 points = ₹167

- Monthly reward value: ₹267

- Annual reward value: ₹3,204

IDFC Select Credit Card Fees and Charges

Zero Annual Fee Structure

- Joining fee: ₹0

- Annual fee: ₹0 (lifetime free)

- Add-on card fee: ₹0

Other Charges

- Forex markup: 1.99% (industry-leading low rate)

- Interest rates: Starting from 8.5% per annum

- Cash withdrawal fee: ₹199 + GST per transaction

- Reward redemption fee: ₹99 + GST per redemption

IDFC Select Credit Card Eligibility Criteria

Who Can Apply?

- Minimum age: 21 years

- Minimum income: ₹25,000 per month

- Good credit score (750+)

- Valid KYC documents

Credit Limit

- Based on income and credit profile

- Shared limit across all IDFC FIRST Bank unsecured cards

- Enhancement available based on usage

Lifestyle Benefits and Offers

Entertainment Perks

- Movie tickets: BOGO offer on District by Zomato (up to ₹125 discount, twice monthly)

- 300+ brand offers: Year-round discounts on dining, shopping, travel

Premium Services

- Golf privileges: 4 complimentary rounds + 12 lessons annually

- Roadside assistance: 24/7 emergency support worth ₹1,399

- Concierge services: Travel planning and booking assistance

IDFC Select Credit Card vs Competitors

How It Compares to Other Lifetime Free Cards

Advantages Over Competitors

- Higher reward rates on incremental spending

- Comprehensive travel insurance

- Airport lounge access (with spend requirement)

- No forex markup compared to 3.5% industry average

- Lower interest rates

Potential Drawbacks

- Spend-based benefit activation

- Reward redemption charges

- Limited international lounge access

Who Should Apply for IDFC Select Credit Card?

Ideal Candidates

- Regular spenders: Can consistently spend ₹20,000+ monthly

- Frequent travelers: Value airport lounge access and travel insurance

- Reward optimizers: Want maximum returns on higher spending

- Budget-conscious users: Want premium benefits without annual fees

Not Suitable For

- Light spenders below ₹15,000 monthly

- Those wanting unconditional lounge access

- Users preferring flat reward rates

IDFC Select Credit Card Application Process

How to Apply Online

- Visit IDFC FIRST Bank official website

- Click “Apply Now” for Select Credit Card

- Fill application form with personal details

- Upload required documents

- Complete video KYC if required

- Wait for approval (typically 7-10 days)

Required Documents

- PAN Card

- Aadhaar Card

- Income proof (salary slips/ITR)

- Bank statements (3 months)

- Address proof

Smart Usage Tips for Maximum Benefits

Optimize Your Rewards

- Concentrate spending: Channel expenses to hit ₹20,000 monthly threshold

- Birthday planning: Save major purchases for birthday month (10X rewards)

- Travel bookings: Use CFAR coverage for expensive non-refundable trips

- EMI conversions: Leverage low interest rates for big purchases

Activation Strategy

- Plan monthly spending to consistently hit ₹20,000

- Use for utility payments, groceries, fuel to reach threshold

- Set calendar reminders for benefit activation timeline

IDFC Select Credit Card Customer Reviews

What Users Say

Positive Feedback

- Excellent customer service

- Quick approval process

- Genuine lifetime free benefits

- Good reward earning potential

Common Concerns

- Spend requirement for lounge access

- Reward redemption charges

- Limited international benefits

Frequently Asked Questions

Is IDFC Select Credit Card Really Free?

Yes, there are no joining fees, annual fees, or renewal charges ever.

How Do I Activate Airport Lounge Access?

Spend ₹20,000 in the current calendar month to activate benefits for the following month.

What’s the Minimum Credit Limit?

Credit limits start from ₹50,000 based on income and credit profile.

Can I Convert Purchases to EMI?

Yes, any transaction above ₹2,500 can be converted to EMI at competitive rates starting from 8.5% per annum.

Final Verdict: Is IDFC Select Credit Card Worth It?

The IDFC FIRST Bank Select Credit Card delivers genuine premium value without the premium price tag. While the spend-to-activate model requires commitment, users who can consistently spend ₹20,000+ monthly will find exceptional value.

Key Takeaways

- Best for: Regular spenders wanting premium benefits without fees

- Annual value potential: ₹15,000-₹20,000 in benefits

- Unique selling point: Lifetime free with genuine premium perks

- Smart strategy: Use as primary card to maximize threshold benefits

For budget-conscious consumers seeking premium credit card benefits, the IDFC Select Credit Card represents one of the best value propositions in the Indian market today.

Affiliate Disclosure: This post may contain affiliate links. If you apply for a credit card through our links, we may receive a commission at no additional cost to you. This helps support our content creation but does not influence our editorial opinions or recommendations.

Important Disclaimer: Credit card terms, benefits, and fees are subject to change. Always verify current terms on the official IDFC FIRST Bank website before applying. This information is for educational purposes only and should not be considered as financial advice. Please consider your financial situation carefully before applying for any credit card.